Eb5 Investment Immigration for Dummies

Eb5 Investment Immigration for Dummies

Blog Article

The Basic Principles Of Eb5 Investment Immigration

Table of ContentsThe smart Trick of Eb5 Investment Immigration That Nobody is DiscussingThe Best Strategy To Use For Eb5 Investment ImmigrationThings about Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration Examine This Report about Eb5 Investment Immigration

Based on our most recent clarification from USCIS in October 2023, this two-year sustainment period starts at the factor when the capital is spent. Overall, the begin of the period has been taken into consideration the point when the money is deployed to the entity liable for job production.Find out more: Understanding the Return of Funding in the EB-5 Refine Recognizing the "in jeopardy" need is essential for EB-5 investors. This principle emphasizes the program's intent to promote authentic financial activity and job development in the USA. The investment comes with integral threats, mindful job selection and compliance with USCIS standards can help capitalists attain their goal: irreversible residency for the capitalist and their family members and the eventual return of their capital.

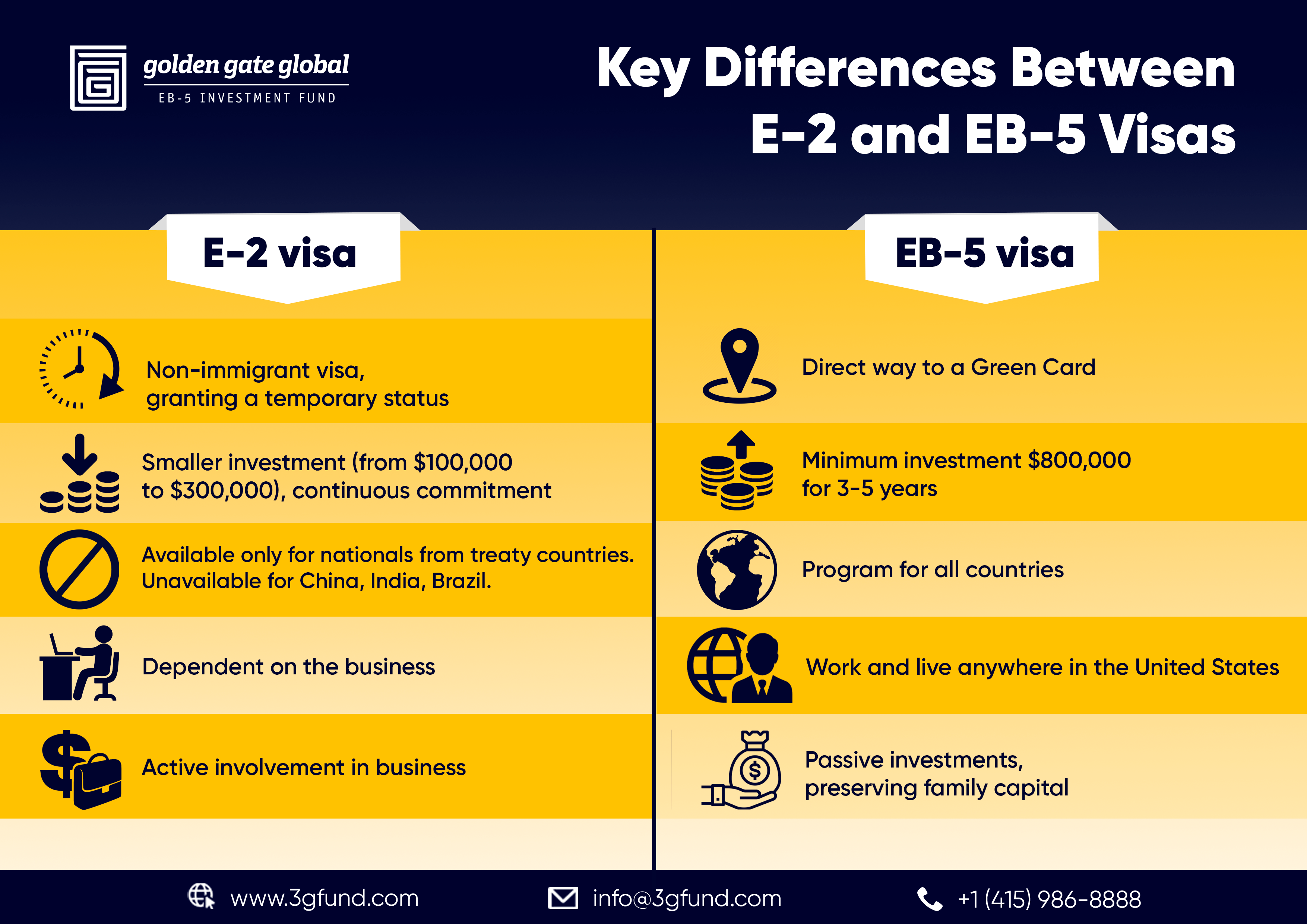

To become eligible for the visa, you are needed to make a minimal financial investment relying on your picked investment option. EB5 Investment Immigration. Two investment options are readily available: A minimum direct financial investment of $1.05 million in an U.S. commercial business outside of the TEA. A minimum financial investment of a minimum of $800,000 in a Targeted Employment Location (TEA), which is a country or high-unemployment location

The 8-Minute Rule for Eb5 Investment Immigration

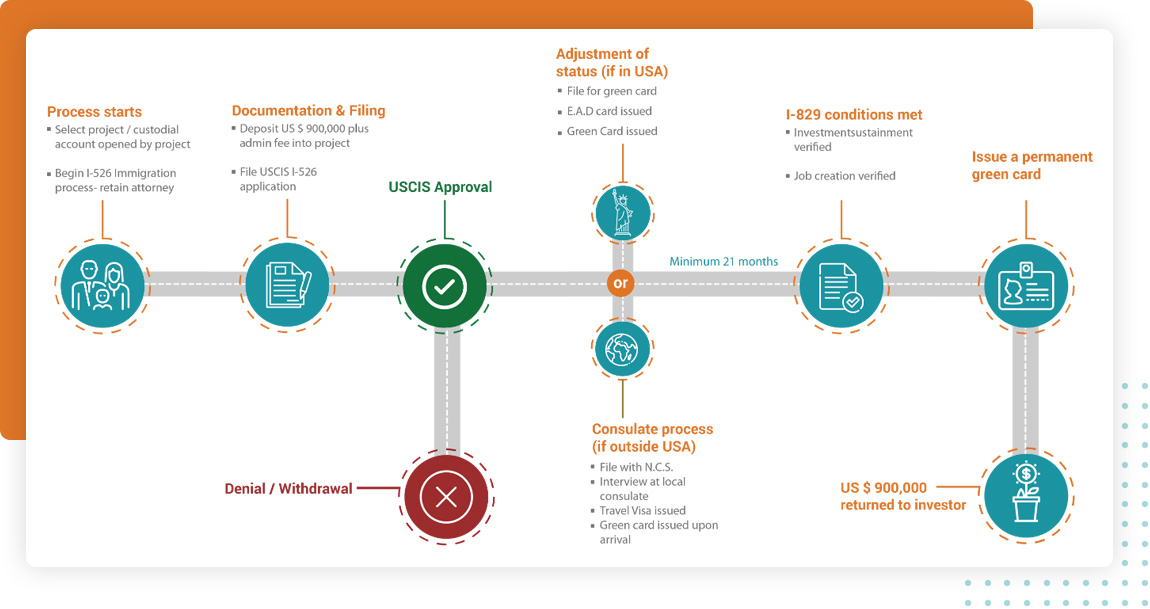

For consular handling, which is done through the National Visa Center, the immigrant visa handling charges payable per individual is $345. If the financier remains in the US in an authorized condition, such as an H-1B or F-1, he or she can submit the I-485 form with the USCIS- for adjusting standing from a non-immigrant to that of irreversible homeowner.

Upon approval of your EB5 Visa, you get a conditional long-term residency for 2 years. You would certainly need to submit a Form I-829 (Application by Capitalist to Eliminate Problems on Permanent Citizen Standing) within the last 3 months of the 2-year validity to eliminate the conditions to come to be an irreversible homeowner.

Nonetheless, based on the EB-5 Reform and Integrity Act of 2022, regional facility capitalists must additionally send out an added $1, 000 USD as part of filing their application. This additional expense does not relate to an amended request. If you picked the alternative to make a straight investment, then you would certainly need to attach a business strategy together with your I-526.

An Unbiased View of Eb5 Investment Immigration

In a straight investment, the investors structure the financial investment themselves so there's no extra administrative charge to be paid. Nonetheless, there can be professional fees birthed by the capitalist to ensure conformity with the EB-5 program, such as lawful charges, business plan composing costs, economic expert charges, and third-party coverage charges to name a few.

The financier is also accountable for obtaining a company plan that complies with the EB-5 Visa requirements. This additional cost can range from $2,500 to $10,000 USD, relying on the nature and structure of the organization. EB5 Investment Immigration. There can be extra costs, if it would be supported, for instance, by marketing research

An EB5 financier ought to likewise think about tax considerations throughout of the EB-5 program: Since you'll become an irreversible local, you will be subject to income tax obligations on your worldwide revenue. Furthermore, you have check my blog to report and pay taxes on any type of earnings obtained from your financial investment. If you market your financial investment, you might undergo a resources gains tax obligation.

Indicators on Eb5 Investment Immigration You Should Know

If you're intending to purchase a regional facility, you can search for ones that have reduced fees but still a high success price. This ensures that you pay out less cash while still having a high opportunity of success. While hiring a legal representative can include to the expenses, they can aid decrease the overall expenses you have to pay in the future as attorneys can make sure that your application is full and precise, which lessens the chances ofcostly blunders or hold-ups.

A Biased View of Eb5 Investment Immigration

The EB5 Investment Immigration areas outside of urban statistical locations that qualify as TEAs in Maryland are: Caroline Region, Dorchester Region, Garrett Region, Kent County and Talbot County. The Maryland Division of Commerce is the marked authority to license areas that qualify as high unemployment locations in Maryland based on 204.6(i). Business licenses geographical areas such as counties, Census designated places or census systems in non-rural regions as areas of high unemployment if they have unemployment rates of at the very least 150 percent of the nationwide joblessness rate.

We review application requests to license TEAs under the EB-5 Immigrant Financier Visa program. EB5 Investment Immigration. Requests will be examined on a case-by-case basis and letters will certainly be released for locations that fulfill the TEA demands. Please examine the actions below to figure out if your recommended task is in a TEA and follow the directions for asking for a qualification letter

Report this page